Getting Started

![]()

Please do not type over a grey cell as it contains a formula.

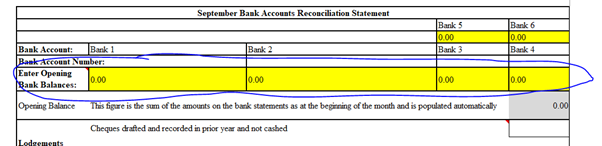

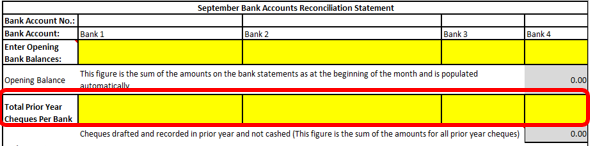

Put your opening bank balances in the Sept Reconciliation Opening Balance yellow boxes

Record previous years uncashed cheques in Sept Reconciliation under Opening Balances.

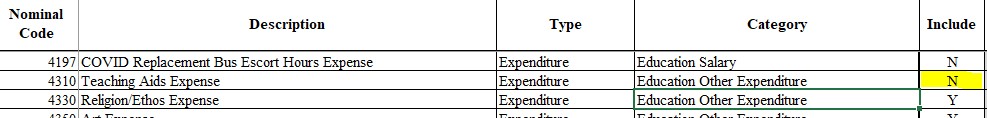

Double click in the category box and type a few characters, then select the down arrow and only categories with those characters will appear.

- Check that the category has ‘Y’ against it on the COA tab. If it has ‘N’ selected change this to ‘Y’ and click on ‘UPDATE HIDDEN COLUMNS’. If it is still not active, please contact us.

- If the category you require is not there, use a suitable alternative. e.g. there is no ‘gymnastics’ category, you could use, games or PE.

Bank Summary Page

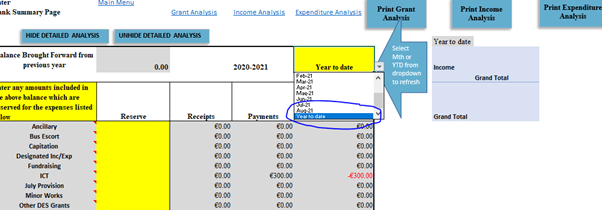

To refresh the page; Click on Year to date and scroll and select Year to date.

- If you see #REF anywhere, please do not proceed but contact us for assistance.

Otherwise

- Refresh the page by clicking on Year to date, and scroll to select Year to date.

- Check bank and date have been selected for every line of information entered throughout the workbook i.e. review each month.

- Only use one category column per row.

- If it is still not correct, please contact us.

Making Changes / Corrections

Yes. Simply go to the instruction tab and change the name. Be sure to go back through any monthly tabs where you used the previous name and change the bank name. It will not change automatically.

Do not attempt to delete an entire line. Instead delete the information in individual cells. If you delete the category, this will clear the category and the amount. Then delete; bank, date, description and reference as required.

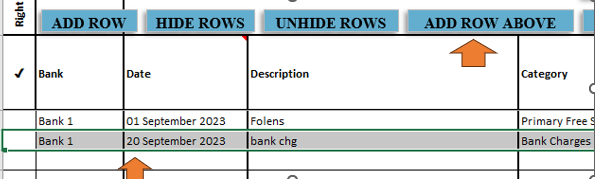

There is an add row button at the top of all monthly income and monthly payments tabs and also the bank reconciliation. Click on ‘ADD ROW” and enter the number of rows you wish to add and click ‘OK’

Yes Select the row below where you want to add a row and click on the blue button.

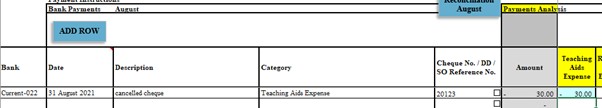

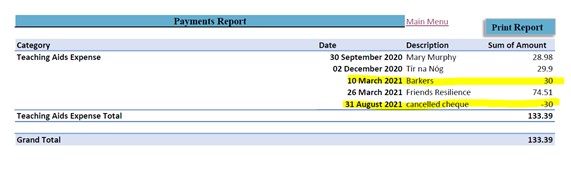

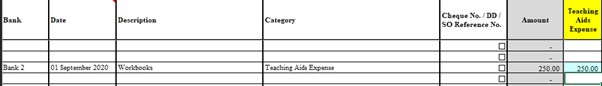

If an uncashed cheque is over 6 months old, or for some reason you have cancelled a cheque it should be written back. This just means putting in a negative expense. Select the relevant bank, date at which cheque is cancelled/written off, and in description put written off or cancelled cheque. Choose the same category as you originally chose for the cheque, e.g. teaching aids, art expense, book grant expense etc. then put a minus amount in the blue cell e.g. -30. This has the advantage of reducing the amount of the overall expense code. So, when you run a report on any of those categories it will include the negative amount and the total is reduced.

Now when you run a payment report for Teaching Aids the total spend for the year is reduced by €30 euro.

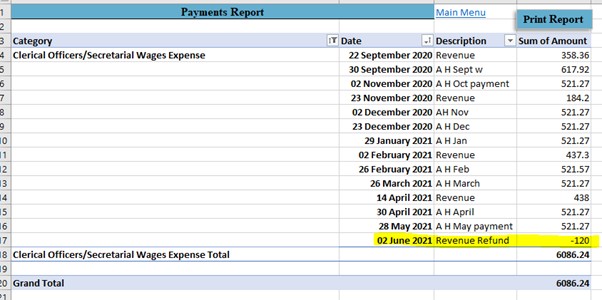

Recording Revenue Payments

- The template does not have a separate category for Revenue payments for PAYE/PRSI.

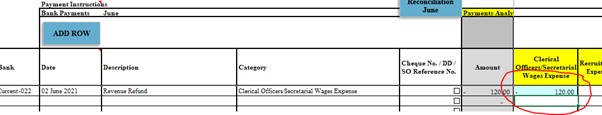

- Breakdown the amount paid to revenue and record the amount over each category of wage paid i.e. clerical wage exp, cleaners wage exp, caretaker wage exp, bus escort wage exp etc.

- The template does not have a separate category for Revenue payments for RCT/VAT.

- Use the same category as the one used to record the payment to the subcontractor. e.g. Minor Works grant expense, Emergency Works grant expense etc.

- You can record them under the Other Income category

or

- Record them as a negative (minus) payment against the original category used when paying revenue. e.g. Overpayment of PRSI/PAYE on secretarial wages, post a negative amount in payments tab, selecting secretarial wages category

- Then when you run the report on caretakers wages the overall cost for the year will be reduced by the refund.

Petty Cash and Credit Cards

- Petty Cash should be set up as a separate bank account on the template. See information on our website and watch this video to show how to record Petty Cash on the template

- Alternatively, you may keep Petty Cash records separately, but be sure to give them to your external accountant at year end.

- Petty Cash expenditure should always be categorised using the categories in the Chart of Accounts (COA).

- The credit card should be set up as a separate bank account.

- Alternatively, if you have kept credit card records separately, please give to your external accountant at year end.

- Credit card expenditure should always be categorised using the categories in the Chart of Accounts (COA).

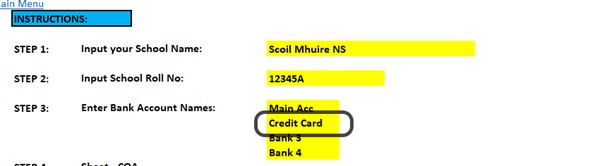

1. Set up the credit card as a bank on the Instructions page:

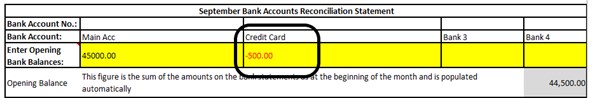

2. In September the opening balance on the Credit Card is the amount owed which will be paid in Sept. The amount is entered as a negative:

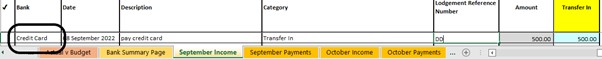

3. When the credit card is paid show it as a transfer out of the Main Account and a transfer into the Credit Card account:

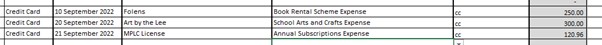

4. When you receive the September Credit Card (or any month) statement, enter the expenditure choosing the relevant categories:

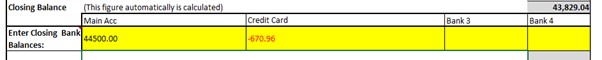

5. Enter closing bank balance of the credit card as the amount owed on the credit card statement. Record as a negative amount:

6. In the following month record the credit card payment by recording transfer out and in as per step 3. above.

Recording Income and Payments

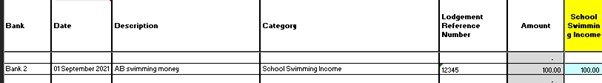

Go to the relevant payment tab e.g. Sept Income. Select a bank, date, put in a description that is useful for yourself. Double click in category box and type the first few characters of the category you want. Click on down arrow and click on the category you want. A cell will light up in blue to the right and you fill the amount in here. It will automatically populate the amount column and other reports throughout the spreadsheet.

- Use a separate line of entry for each category of receipt

- If there isn’t an exact match e.g. Gymnastics, you can record this against another suitable category such as Games Income or Other School Generated Income. Just be consistent in your choices.

Go to the relevant payment tab e.g. Sept Payments. Select a bank, date, put in a description that is useful for yourself. Double click in category box and type the first few characters of the category you want. Click on down arrow and click on the category you want. A cell will light up in blue to the right and you fill the amount in here. It will automatically populate the amount column and other reports throughout the spreadsheet.

- Divide the amount of the payment over the different categories that it relates to e.g. Covid cleaners wage expense, cleaners wage expense.

- A cheque given to a teacher might be split over teaching aids and art expense.

- Be sure to use a separate line of entry for each category

- The template does not have a category for DEIS expenditure.

- When recording payments made under the DEIS category use DEIS in the description and you can run a report showing the total amount spent on DEIS year to date.

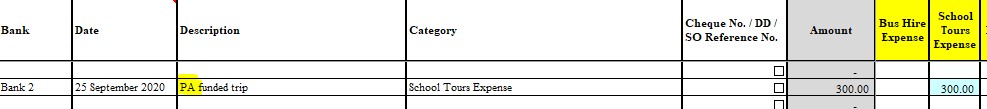

- The template does not have a category for Parents Association expenditure.

- When recording payments use PA in the description and you can run a report showing the total amount spent from PA funds received.

Reports

On the individual tabs you will find blue buttons which you can click these to print reports e.g.

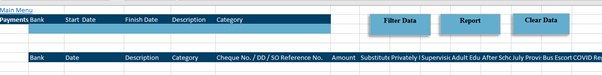

From main menu select Payment Transactions.

Choose the criteria for the report by selecting, bank, dates etc.

In the blue cells select the criteria you want to report on. If you leave all cells blank and click on Filter Data it will show all payments entered to date.

From the drop down menu under Bank you can select an individual bank and the report will only include that bank account. If you do not select a bank, all banks will be included in the report.

If you select a start and finish date the report will only include items in that time period.

If you only select one category the report will only include items for that category.

Once criteria have been set. Click on Filter Data and then Report the report opens in the Payments report tab and you can print from here.

Go back to payments transactions tab and click on Clear Data. You can now perform another search.

From main menu select Receipt Transactions.

In the blue cells select the criteria you want to report on. If you leave all cells blank and click on Filter Data it will show all entries to date.

From the drop down menu under Bank you can select an individual bank and the report will only include that bank account. If you do not select a bank, all banks will be included in the report.

If you select a start and finish date the report will only include items in that time period.

If you only select one category the report will only include items for that category.

Once criteria have been set. Click on Filter Data and then Report the report opens in the Payments report tab and you can print from here.

Go back to payments transactions tab and click on Clear Date. You can now perform another search.

The reports below should be considered in advance and should be made available to each Board member:

- Monthly School Income and Expenditure

- Bank Reconciliation Statement for each Bank Account

- Capital Income and Expenditure Account if relevant

- Budget v’s Actual Report

- Prior Year v’s Actual Report

If you have a query about the new system that is not addressed in these FAQs, please email us at primary@fssu.ie.